The Hungarian Tax Authority NAV's has formed an Artificial Intelligence Working Group (MIMCS) to conduct future research based on the data assets of the tax office.

The tasks of the working group created in April 2022 include the development of a proposal for a semantic data asset methodology for machine learning. Work will also concern research on algorithms and the development of validation methodologies. Although the research data will be anonymous, data protection rules will be considered as a limit to the operations.

In addition to the findings of artificial intelligence, information provided by taxpayers in the form of filings, there is a constant influx of data into the electronic systems of the Tax Authority also from third parties. Below we examine these sources of information and the legal grounds that they are based upon.

Certain third parties are obliged to provide tax information to the Hungarian Tax Authority automatically or upon request by law. These include banks and insurances which need to fulfill reporting requirements. Contracting parties under civil law are also required to provide tax relevant information. In addition there is a system of exchange of tax information with foreign tax authorities in the European Union and in other states.

VAT-related filings, such as VAT-returns or Intrastat are an important source of information for tax authorities world-wide. In Hungary the Tax Authority NAV has direct access to invoices issued by taxpayers, because, as based on specific rules, the content of invoices including VAT must electronically be transmitted to the Tax Authority upon issuance. Also, the movement of goods by transportation in Hungary is monitored by a digital system called EKAER, where companies must declare the precise route of goods delivered. While the system was initially designed to prevent VAT fraud, it contains a plethora of information that the Tax Authority can use in tax audits. As of 1st January 2021, only those products must be reported for EKAER, which are listed in the Schedule to the Decree 51/2014 (Dec 31) of the Minister for the National Economy on the determination of risky products in association with the operation of the Electronic Public Road Transportation Control System.

The Tax Authority also has the possibility to obtain information from other state or private digital databases, such as systems in the private economy containing customer information. Many of these systems are accessed by customers on the internet. Typical examples are hotel reservations and other booking platforms, credit card and similar payment systems, even computer games. The availability of information is not restricted to Hungarian providers, but it can be also obtained within the framework of international cooperation between the Tax Authority in Hungary and tax authorities abroad.

A network of international tax treaties, mostly on a bilateral but also on a multilateral basis make it possible for tax authorities to exchange tax information with states not just inside, but also outside of the European Union. The most extensive regulations in this respect, however, have been implemented in Hungary based on the directives of the European Union.

For example, a Hungarian company not reporting its related companies and not documenting its transfer pricing transactions will easily be detected. The transparency of the system can also be illustrated by a Swedish investor investing in several apartments in Budapest and renting them out through Airbnb. In this case, the Hungarian and the Swedish Tax Authorities will have total transparency on the income of the Swedish individual, because Airbnb as an Irish company is obliged to supply information to the Irish Revenue which will be shared with the other two related tax authorities.

The exchange of information in tax matters within the European Union was introduced in 2013 by Council Directive 2011/16/EU. The Directive provides for mandatory exchange of five categories of income and assets:

The scope has later been extended to

These latter forms of information exchange apply not just in the European Union. They have been introduced in many other jurisdictions as well, as based on the international standard of the OECD. However, the exchange of tax information in the EU goes further than in the OECD, providing also for a practical framework to exchange information - i.e. standard forms for exchanging information on request and spontaneously, as well as computerised formats for the automatic exchange of information. The EU has implemented secured electronic channels for the exchange of information and a central directory for storing and sharing information on cross-border tax rulings, advance pricing arrangements and tax planning schemes.

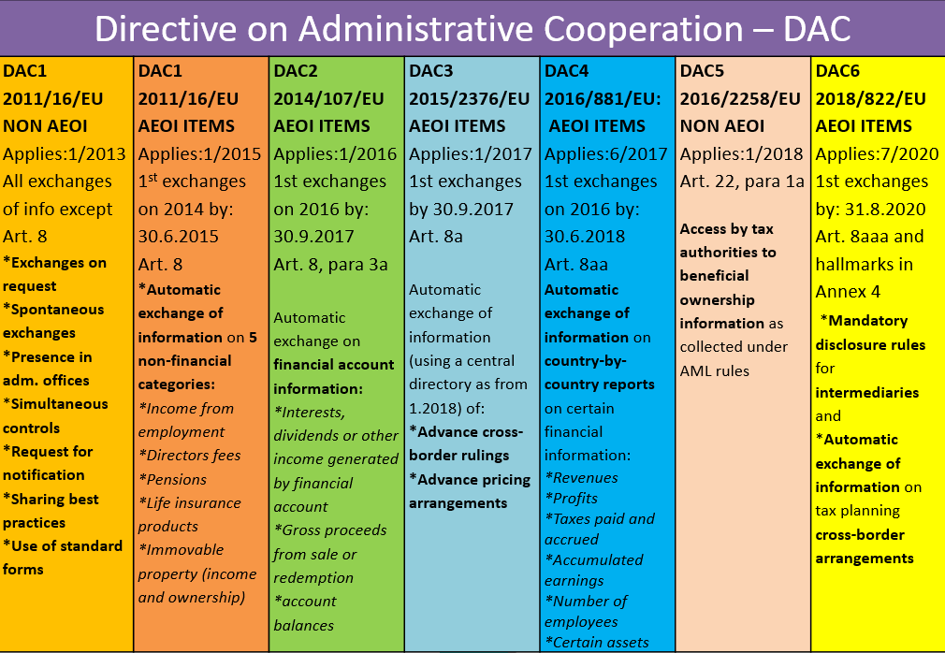

The table below indicates the steps by which today’s extensive exchange of tax information in the EU has been developed.

Source: European Commission

The broad exchange of information on taxpayers raises the question if data protection principles are respected at all times, with special attention to the rules of the GDPR. This aspect of tax information exchange has been the subject of several court decisions in the European Union.

The issue that the courts have examined is the legal grounds for handling personal data and if the process entailed any breaches of privacy through the tax authorities. These cases are increasingly complex, but it can generally be stated that privacy is a fundamental right of the taxpayer and any limitations to it, such as information exchange between tax authorities, must be proportionate and necessary to protect the general interest.

We are dedicated to adding value to our clients’ businesses through understanding their objectives and supporting them in achieving their goals. With over 20 years of international experience and a strong focus on digitalization we provide full scale professional services at a single point of contact.

In our Case Studies we have described some examples of how we work for our clients and what benefits we have achieved for them.

A member firm of DFK International a worldwide association of independent accounting firms and business advisers

Local solutions

for

international

businesses

Expert advice, proven results.

Trusted by leading businesses.

Businesses looking to permanently outsource their accounting and reporting functions can benefit from our full-scale, fully digitalized accounting solutions, including a wide range of professional services.

Our outsourced accounting services are built on three pillars:

Depending on your preference, we will maintain your accounts in HUF or any other functional currency such as EUR, USD, or CHF. We also manage all interconnected tasks arising from foreign currency accounting.

Our comprehensive accounting services include filing financial statements and registering your firm in the electronic systems of the Hungarian tax administration. We also prepare and submit your tax returns electronically.

If your company requires a tailored management information system in Hungary, we will adapt our services to align with your preferred accounting system, policies, and data format.

Our fully digital accounting platform streamlines financial management for businesses of all sizes. With a cloud-based system, our clients can gain real-time access to their accounting data, ensuring accuracy, transparency, and efficiency. The integration of tax compliance features also ensures that businesses remain up to date with local regulations, avoiding costly penalties.

We will generate detailed financial reports tailored to our clients’ needs, a further useful function of our fully digital accounting system. These reports provide valuable insights into cash flow, profitability, and the overall financial status, enabling better decision-making.

Another key advantage is the flexibility of digital collaboration between our clients and their accountants. A centralized platform allows for efficient document sharing and direct communication with our financial professionals. This enhances workflow efficiency and ensures that accounting tasks are completed accurately and on time. Whether managing payroll, tax filings, or financial planning, our clients benefit from a reliable, secure, and scalable accounting solution tailored to their specific needs.

We understand the importance of a smooth and efficient accounting process, also in cases when you wish your financial data to be integrated in your company’s own ERP-system. To ensure that financial data is seamlessly integrated into your ERP we handle the direct upload of your accounting data, eliminating errors and saving valuable time.

This automated process ensures that your company always has access to up-to-date financial records, improving accuracy and operational efficiency. Quarterly, monthly or weekly financial reporting enhances decision-making by providing your management team with precise, reliable insights.

We tailor our accounting services to our clients’ needs—whether for permanent outsourcing or for temporary support until an in-house accounting department is established.

We provide expert accounting advice, especially valuable in the early stages of business operations. Our team also advises on implementation and compatibility related to IFRS, US-GAAP, and Hungarian Accounting Standards.

While most companies in Hungary maintain accounts in Hungarian Forints (HUF), this may not be ideal for internationally active businesses. We guide our clients through the process of transitioning their accounting system to a preferred functional currency, such as EUR, USD, or CHF.

Once implemented, we support your accounting team in maintaining the accounts, compiling financial statements, and managing all related tasks in the chosen currency.

We offer payroll services for companies that require complete confidentiality of salaries or find it impractical to employ an in-house payroll team. This is particularly beneficial for:

Our payroll experts meet all legal requirements for handling payroll for companies with over 100 employees.

We handle full-scale payroll administration, allowing your company to focus on core business operations. Our services include:

Most clients who outsource their accounting with us also choose to use our payroll services.

For an estimate of employer wage costs, you can use our online salary calculator.

International businesses that do not wish to maintain a physical office in Hungary can outsource their registered office to us.

We can:

A registered office is a supplementary service available to clients outsourcing their accounting and reporting with us.

© 2025

© 2025