The legal possibilities in transfer pricing for tax planning have become narrower in 2023. The benchmark range that can be used to determine transfer prices has been reduced, and the possibility of tax optimization with year-end transfer price changes has been basically eliminated. Details of the transfer pricing documentation have retroactively become part of the tax return already for the 2022 tax year.

Transfer pricing provides significant tax planning opportunities for international enterprises. One of the options concerning routine companies in Hungary is to optimally determine transfer prices between affiliated companies with the help of database analyses (benchmark studies).

The transaction-based net margin method (TNMM) is the main method used to determine transfer prices and it is based on financial data from comparable companies (peer groups). The financial data can be obtained from special company databases containing information on around 500,000 companies operating in Hungary.

Databases for transfer pricing purposes contain financial data that can be used to compile benchmark analyses. Thus, the profit margin of independent companies, usually on an EBIT basis, is compared and used for determining transfer prices. The Hungarian regulations in this area follow the OECD transfer pricing guidelines and the EU transfer pricing policy.

According to the current rules, the independent profit rates used to determine the transfer price can only be selected within the interquartile range. The previous Hungarian regulations allowed companies a choice within the entire range of benchmark percentages to set transfer prices. The change in the law already applies to the tax return for the tax year 2022, which must be submitted in 2023.

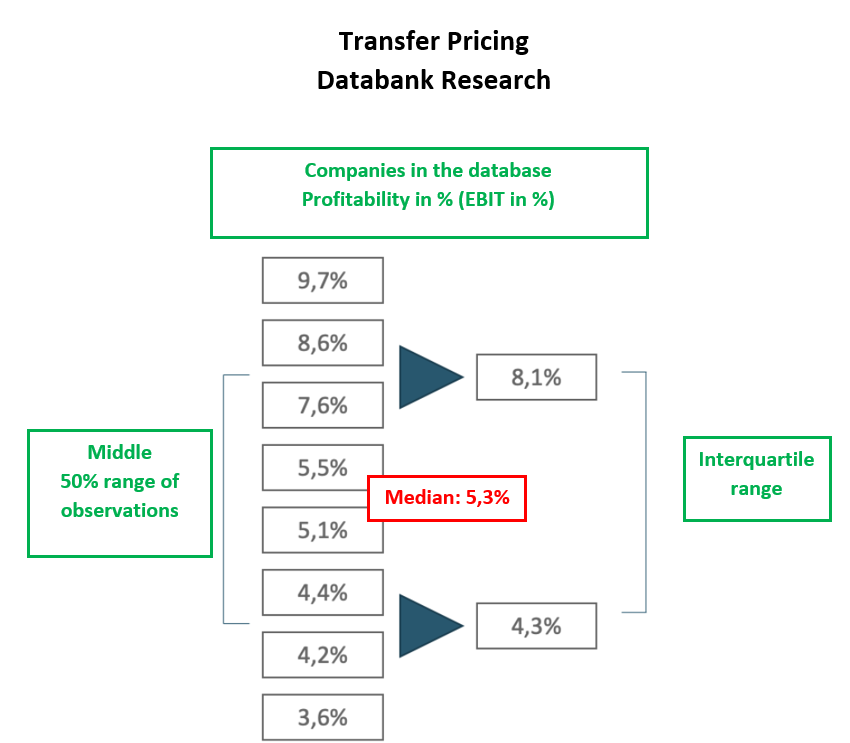

Compared to before, the choice has therefore narrowed from the full range to the interquartile range, i.e. 50% of the range cannot be taken into account. In the case of tax audits, the tax office basically adjusts incorrect transfer prices to the median value, i.e. to the middle value within the range.

The definition of the median and interquartile range is shown in the figure below:

Until now, many companies have used the opportunity to retrospectively review transfer prices before submitting their year-end tax return, thus modifying the tax base by the end of the financial year within the limits allowed by law in Hungary and the European Union. According to the current rules, this method of tax optimization can only be applied with limitations and it can no longer be used if the current profit rate is within the standard market range. These rules must first be implemented in the tax return for the 2022 tax year.

When determining the tax base, the legally possible scope for tax planning is illustrated by the following example:

Example:

A Hungarian company sells machine parts to its Danish parent company. The Hungarian routine company established the transfer prices based on the results of the database analysis included in the table above.

a) The company's legally permissible adjustment option with regard to planning the tax burden is currently an EBIT margin between 4.3% and 8.1%. So far, the range of options for setting transfer prices was between 3.6% and 9.7%. The change in the law thus reduces the options of determining transfer prices to follow the value chain.

b) Let us suppose that the EBIT-rate of the Hungarian company at the end of the business year is at 4.5%, i.e. in the lower part of the interquartile range. Based on the company's financials, it might make sense to increase the EBIT margin in Hungary to 8% at the end of the year, i.e. to follow the upper limit of the interquartile range. According to the current rules, this correction is no longer possible, the difference in the EBIT margin of 3.5% will remain with the Danish parent company.

A new rule to be applied for the first time in 2023 requires data on transfer prices with related parties to be provided in the corporate income tax return retrospectively relating to 2022. The tax return must provide detailed information on transfer prices such as the value and description of transactions, the activity code for transactions and the comparable market price or price range. The purpose of the new regulation is to facilitate for the tax authorities the analysis of taxpayer risk and the selection of taxpayers to be audited.

The deadline for data provision and tax declaration is May 31, 2023. This deadline also applies to the preparation of the transfer pricing documentation. It is therefore important to prepare the transfer pricing documentation within the deadline, as the data are also to be included in the corporate income tax return.

The obligation to create detailed transfer pricing documentation applies if the total of similar deliveries of goods or comparable services to affiliated companies amounts to at least HUF 100 million (ca. EUR 250,000).

The fine related to transfer pricing documentation has increased from HUF 2 million to HUF 5 million, in case of repeated failure the maximum amount of the fine is HUF 10 million.

Summary

In summary, it can be concluded that the legal possibilities for tax planning using transfer prices have narrowed as a result of the new amendments, while the administrative burden on companies has increased. Nevertheless, transfer prices can be legally optimized for tax purposes, albeit under stricter legal requirements.

It is important to note that harmonization of profit distribution and value creation should ideally take place when starting a new business in Hungary. The fiscally optimal redesign of existing transfer pricing structures may also be carried out later, however within the limitations of the existing legal framework.

We are dedicated to adding value to our clients’ businesses through understanding their objectives and supporting them in achieving their goals. With over 20 years of international experience and a strong focus on digitalization we provide full scale professional services at a single point of contact.

In our Case Studies we have described some examples of how we work for our clients and what benefits we have achieved for them.

A member firm of DFK International a worldwide association of independent accounting firms and business advisers

Local solutions

for

international

businesses

Expert advice, proven results.

Trusted by leading businesses.

Businesses looking to permanently outsource their accounting and reporting functions can benefit from our full-scale, fully digitalized accounting solutions, including a wide range of professional services.

Our outsourced accounting services are built on three pillars:

Depending on your preference, we will maintain your accounts in HUF or any other functional currency such as EUR, USD, or CHF. We also manage all interconnected tasks arising from foreign currency accounting.

Our comprehensive accounting services include filing financial statements and registering your firm in the electronic systems of the Hungarian tax administration. We also prepare and submit your tax returns electronically.

If your company requires a tailored management information system in Hungary, we will adapt our services to align with your preferred accounting system, policies, and data format.

Our fully digital accounting platform streamlines financial management for businesses of all sizes. With a cloud-based system, our clients can gain real-time access to their accounting data, ensuring accuracy, transparency, and efficiency. The integration of tax compliance features also ensures that businesses remain up to date with local regulations, avoiding costly penalties.

We will generate detailed financial reports tailored to our clients’ needs, a further useful function of our fully digital accounting system. These reports provide valuable insights into cash flow, profitability, and the overall financial status, enabling better decision-making.

Another key advantage is the flexibility of digital collaboration between our clients and their accountants. A centralized platform allows for efficient document sharing and direct communication with our financial professionals. This enhances workflow efficiency and ensures that accounting tasks are completed accurately and on time. Whether managing payroll, tax filings, or financial planning, our clients benefit from a reliable, secure, and scalable accounting solution tailored to their specific needs.

We understand the importance of a smooth and efficient accounting process, also in cases when you wish your financial data to be integrated in your company’s own ERP-system. To ensure that financial data is seamlessly integrated into your ERP we handle the direct upload of your accounting data, eliminating errors and saving valuable time.

This automated process ensures that your company always has access to up-to-date financial records, improving accuracy and operational efficiency. Quarterly, monthly or weekly financial reporting enhances decision-making by providing your management team with precise, reliable insights.

We tailor our accounting services to our clients’ needs—whether for permanent outsourcing or for temporary support until an in-house accounting department is established.

We provide expert accounting advice, especially valuable in the early stages of business operations. Our team also advises on implementation and compatibility related to IFRS, US-GAAP, and Hungarian Accounting Standards.

While most companies in Hungary maintain accounts in Hungarian Forints (HUF), this may not be ideal for internationally active businesses. We guide our clients through the process of transitioning their accounting system to a preferred functional currency, such as EUR, USD, or CHF.

Once implemented, we support your accounting team in maintaining the accounts, compiling financial statements, and managing all related tasks in the chosen currency.

We offer payroll services for companies that require complete confidentiality of salaries or find it impractical to employ an in-house payroll team. This is particularly beneficial for:

Our payroll experts meet all legal requirements for handling payroll for companies with over 100 employees.

We handle full-scale payroll administration, allowing your company to focus on core business operations. Our services include:

Most clients who outsource their accounting with us also choose to use our payroll services.

For an estimate of employer wage costs, you can use our online salary calculator.

International businesses that do not wish to maintain a physical office in Hungary can outsource their registered office to us.

We can:

A registered office is a supplementary service available to clients outsourcing their accounting and reporting with us.

© 2025

© 2025